Value Creation vs. Value Capture: Decoding Synergy Management in M&A and Portfolio Strategies

A Practical Guide to Understanding, Measuring, and Balancing Short-Term Gains with Long-Term Growth

Introduction:

In the world of Mergers & Acquisitions (M&A) and Investment firms, the terms value creation and value capture are often used interchangeably. However, as a practitioner with extensive experience leading deals at Microsoft and managing portfolios, I’ve seen how misunderstanding these terms can hinder the success of deals and integrations.

While both concepts aim to generate returns, their approaches, goals, and timelines differ significantly. Mismanaging this balance—whether in tech M&A or private equity—can mean the difference between a thriving acquisition and a costly failure. This blog dives into the nuances of these strategies, how they apply in different scenarios, and offers examples like Microsoft, Blackstone, and Bain Capital to illustrate their impact.

What Is Value Creation vs. Value Capture?

Value Creation

• Focus: Generating new economic value through innovation, market expansion, and operational improvements.

• Objective: Build long-term sustainability and growth.

• Example: Microsoft acquiring LinkedIn to create a seamless integration between its productivity tools and LinkedIn’s professional network, opening new revenue streams.

Value Capture

• Focus: Securing immediate benefits through cost-cutting, financial engineering, or synergies.

• Objective: Maximize short-term financial returns.

• Example: Bain Capital’s acquisition of Toys “R” Us prioritized cost reduction but neglected the innovation necessary to stay relevant in a changing retail market.

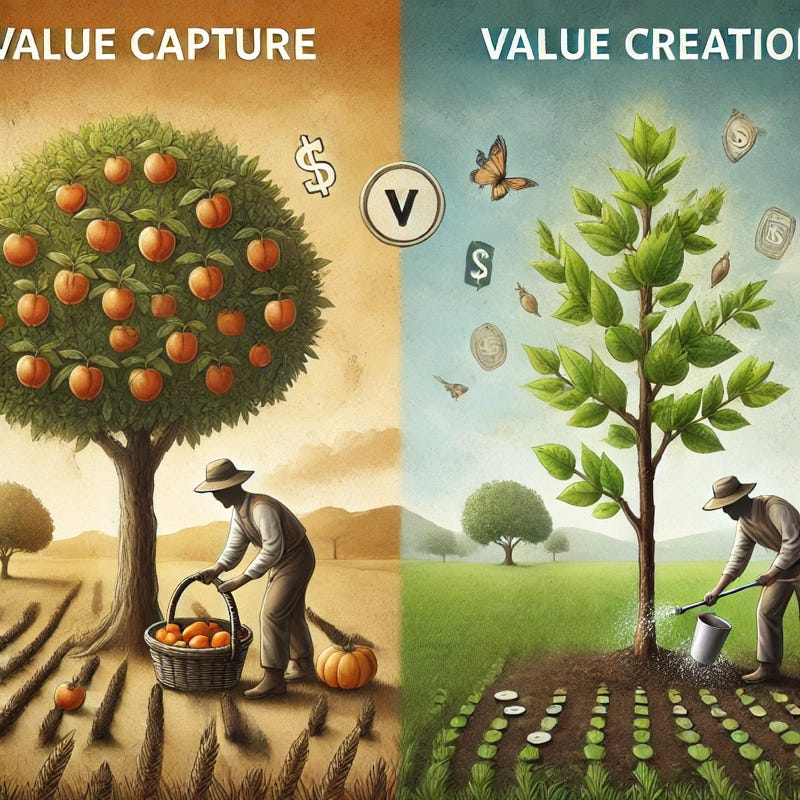

In essence:

• Value creation enlarges the pie.

• Value capture ensures you take the biggest possible slice.

Real-World Examples: The Good and the Bad

1. Microsoft’s M&A Playbook

• Value Creation: Microsoft’s 2016 acquisition of LinkedIn is a standout example of value creation. By seamlessly integrating LinkedIn into its productivity suite—such as Office 365 and Teams—and harnessing the power combined portfolio, Microsoft expanded its ecosystem and unlocked long-term revenue streams that now exceed $10 billion annually. This acquisition marked a pivotal moment for Microsoft, requiring a fresh approach to integration, one that prioritized building value over capturing it. Credit goes to Amy Hood and Satya Nadella for championing a growth mindset, steering the strategy toward innovation and collaboration rather than immediate financial optimization. Their vision redefined on how we look at acquisition integration and since then every acquisition integration goes through this lens. Look at the example of Github which followed a similar integration strategy.

• Value Capture Gone Wrong: Microsoft’s 2014 acquisition of Nokia’s Devices business exemplifies the risks of an overemphasis on value capture. The strategy focused on rapidly securing market share in mobile devices but lacked alignment with Microsoft’s long-term vision. This misstep ultimately led to a significant write-off. Shortly afterward, Microsoft launched the Surface Duo, running a forked Android version—a move that raises the question of whether such a strategy might have been better aligned with Nokia’s capabilities. While multiple factors contributed to the divestment of the Nokia business, this disconnect between short-term goals and strategic integration was likely a key driver. This marked the last time we fully adhered to a “one-size-fits-all” playbook approach, signaling the need for more adaptable and nuanced strategies moving forward.

2. Blackstone’s Acquisition of Hilton

• Balanced Success: Blackstone demonstrated a masterful blend of strategies. Initially, they captured value through operational streamlining and cost optimization. Over time, they created value by expanding Hilton’s global presence and investing in digital capabilities like Hilton Honors. This balanced approach turned a struggling asset into a record-breaking $14 billion profit after Hilton’s IPO.

3. Bain Capital’s Toys “R” Us Fiasco

• Overreliance on Value Capture: Bain Capital’s strategy focused on aggressive cost-cutting and leveraging debt to extract short-term gains. However, this neglect of long-term value creation—like enhancing customer experience or embracing e-commerce—led to bankruptcy. It’s a cautionary tale of what happens when you prioritize the slice over the pie.

The Role of Synergy Management

In M&A and portfolio management, synergy management bridges the gap between value creation and value capture. It ensures that deals not only generate quick returns but also foster long-term growth.

How Synergy Management Balances Both

1. Early Integration (Value Capture):

• Identify and implement cost-saving opportunities.

• Consolidate operations to achieve immediate synergies.

• Example KPI: Achieving cost reductions within six months.

2. Sustainable Growth (Value Creation):

• Invest in innovation, market expansion, and talent retention.

• Develop new products or services to unlock untapped potential.

• Example KPI: Revenue growth in new markets or product categories.

3. Balanced Metrics of Success:

• Cost synergies, EBITDA improvement, and integration speed for value capture.

• Revenue growth, customer retention, and innovation for value creation.

Key Performance Indicators (KPIs) to Measure Success

Value Creation : Revenue growth, market share expansion, innovation metrics, NPS scores.

Value Capture : Cost synergies, EBITDA improvement, debt leverage metrics, integration speed.

Measuring Both:

Early integration should focus on value capture KPIs (e.g., cost savings), while post-stabilization shifts toward value creation KPIs (e.g., revenue growth and innovation).

Key Considerations:

Balance Is Critical:

• Over-prioritizing value capture (e.g., Bain Toys “R” Us) risks long-term viability.

• Solely focusing on value creation can delay returns (e.g., underestimating cost synergies).

Tailor Strategies to Context:

• In technology acquisitions (e.g., Microsoft-LinkedIn), focus on long-term ecosystem growth.

• In private equity (e.g., Blackstone-Hilton), balance operational efficiency with growth investments.

Invest in Synergy Management:

• Synergies are not just about cost savings; they’re about creating new capabilities and market advantages.

Conclusion: Aligning Strategies for Long-Term Success

The interplay between value creation and value capture defines the success of any M&A or portfolio initiative. As seen in Microsoft’s approach and the contrasting examples of Blackstone and Bain Capital, both strategies are essential but must be carefully balanced.

For executives, investors, and portfolio managers, the lesson is clear: Start with value capture for quick wins, but never lose sight of value creation to ensure long-term sustainability and growth. By mastering synergy management, you can unlock the full potential of any deal or investment.

Reference material:

“Value Creation vs. Value Capture: What’s the Difference?” – Harvard Business Review

Paul Verdin’s Research Paper: Value Capture vs. Value Creation – Harvard Kennedy School (2023)

Ready to build lasting value in your portfolio? Let’s connect and explore how these principles can transform your strategy.

#microsoft #m&a #merger #acquisition @